Charitable Remainder Unitrust

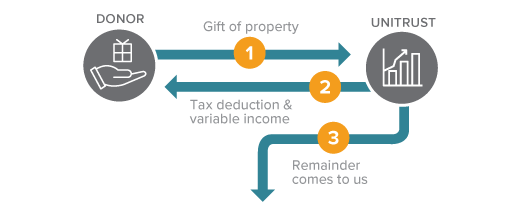

How It Works

- You transfer cash, securities, or other appreciated property into a trust. The required minimum for this type of gift is $250,000.

- The trust pays a percentage of the value of its principal, which is valued annually, to you or beneficiaries you name.

- You may use your real estate to fund a charitable remainder unitrust (CRUT), which may be structured to provide lifetime income for you and/or others, or income for a term of years.

- When the trust terminates, the remainder passes to Springpoint Foundation in support of their overall mission.

Benefits

- Receive income for life or a term of years in return for your gift.

- Receive an immediate income tax deduction for a portion of your contribution.

- Pay no up-front capital gains tax on appreciated assets you give.

- You may be able to make additional gifts to the trust as your circumstances allow for additional income and tax benefits.