Giving from Your 401k or IRA Retirement Plan

You've worked hard and planned for retirement. Now, with a little creativity, you can leverage your retirement assets to benefit you and your family, reduce federal taxes, and support the Foundation far into the future.

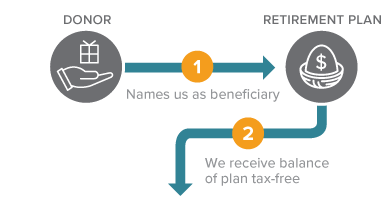

How It Works

- Name Springpoint Foundation as a beneficiary of your IRA, 401(k), or other qualified retirement plan.

- Pass the balance of your retirement assets to the Foundation by contacting your plan administrator.

- Important! Tell the Foundation about your gift. Your plan administrator is not obligated to notify us, so if you don't tell us, we may not know.

70 ½ or older? Make a “Tax-Free” Gift Through Your IRA

- Qualified Charitable Distribution (IRA Rollover)

Note: The SECURE Act increased the MRD (Minimum Required Distribution) age from 70½ to 73. The age for a Qualified Charitable Distribution (QCD), however, still remains at 70½.

Benefits

- Continue to take regular lifetime withdrawals.

- Maintain flexibility to change beneficiaries if your family's needs change during your lifetime.

- Your heirs avoid the potential double taxation on the assets left in your retirement account.

Next

- Frequently asked questions on retirement plans.

- Contact us so we can assist you through every step.